IRAQ’S INVASION OF KUWAIT AND THE GULF WAR (1990–1991) AND THE ASIAN CRISIS AND OPEC’s MISCALCULATION (1997–1998)

THE ASIAN CRISIS AND OPEC’s MISCALCULATION (1997–1998)

The next major move in oil would take place in 1997–1998, when a mis-timed decision by OPEC to raise production coincided with a two-year re-cession in Southeast Asia. Oil prices had doubled between 1994 and 1996, thanks to a combination of oil workers’ strikes disrupting production in Nigeria, extremely cold weather in the United States and Europe, and the strike of U.S. cruise missiles into southern Iraq following an Iraqi invasion of Kurdish safe-haven areas in northern Iraq. In December 1996, oil peaked at $23.22 per barrel, its highest level since the 1991 Gulf War.

Prices began their steep decline in January 1997 when the United Na-tions authorized Iraq to double the amount of oil it could export as part of the oil-for-food sales agreement. But the oil price decline was interrupted in summer 1997 when Iraq refused United Nations weapons inspectors ad-mission into key sites, raising fears of a renewed conflict in the Middle East. The run-up in oil prices extended into the fourth quarter of 1997, pushing OPEC to make the first output increase in four years, raising its production ceiling by 2.5 million barrels per day to 27.5 million barrels per day. OPEC’s 10 percent production increase drove up total world output by 3.1 percent in 1997, the highest annual increase in 10 years.

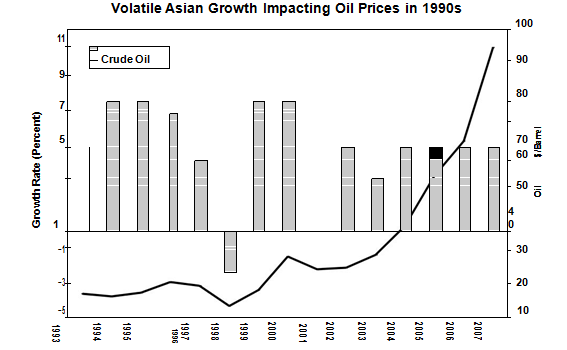

Figure 2.14 shows the resulting price decline of OPEC’s supply hikes to have been especially accelerated by the so-called Asian flu of 1997–1998. Economies in newly industrial Asian countries (Hong Kong, South Korea, Singapore, and Taiwan) saw their GDP growth drop from 4.5 percent in 1997 to -3.6 percent in 1997, while total domestic demand plummeted from 4 percent in 1997 to -9.2 percent in 1998. Unemployment growth went from 2.1 percent in 1996 to -2.7 percent in 1998, and import vol-umes tumbled 8.9 percent in 1998 after averaging 7.1 percent in 1993–2002. It was Pacific Asia’s first drop in oil demand since 1982. Sharp currency depreciations, soaring interest rates, and political unrest damaged domes-tic demand. What began as an attack on local currencies in 1997 translated into massive debt defaults and the freezing of foreign capital in 1998. Oil prices continued to plummet as increased production from Iraq coincided with zero growth in Asian oil demand due to the Asian crisis and escalating oil inventories. Prices dropped to $9.40 per barrel in December 1998, losing 60 percent from their December 1996 high.

The next major move in oil would take place in 1997–1998, when a mis-timed decision by OPEC to raise production coincided with a two-year re-cession in Southeast Asia. Oil prices had doubled between 1994 and 1996, thanks to a combination of oil workers’ strikes disrupting production in Nigeria, extremely cold weather in the United States and Europe, and the strike of U.S. cruise missiles into southern Iraq following an Iraqi invasion of Kurdish safe-haven areas in northern Iraq. In December 1996, oil peaked at $23.22 per barrel, its highest level since the 1991 Gulf War.

Prices began their steep decline in January 1997 when the United Na-tions authorized Iraq to double the amount of oil it could export as part of the oil-for-food sales agreement. But the oil price decline was interrupted in summer 1997 when Iraq refused United Nations weapons inspectors ad-mission into key sites, raising fears of a renewed conflict in the Middle East. The run-up in oil prices extended into the fourth quarter of 1997, pushing OPEC to make the first output increase in four years, raising its production ceiling by 2.5 million barrels per day to 27.5 million barrels per day. OPEC’s 10 percent production increase drove up total world output by 3.1 percent in 1997, the highest annual increase in 10 years.

Figure 2.14 shows the resulting price decline of OPEC’s supply hikes to have been especially accelerated by the so-called Asian flu of 1997–1998. Economies in newly industrial Asian countries (Hong Kong, South Korea, Singapore, and Taiwan) saw their GDP growth drop from 4.5 percent in 1997 to -3.6 percent in 1997, while total domestic demand plummeted from 4 percent in 1997 to -9.2 percent in 1998. Unemployment growth went from 2.1 percent in 1996 to -2.7 percent in 1998, and import vol-umes tumbled 8.9 percent in 1998 after averaging 7.1 percent in 1993–2002. It was Pacific Asia’s first drop in oil demand since 1982. Sharp currency depreciations, soaring interest rates, and political unrest damaged domes-tic demand. What began as an attack on local currencies in 1997 translated into massive debt defaults and the freezing of foreign capital in 1998. Oil prices continued to plummet as increased production from Iraq coincided with zero growth in Asian oil demand due to the Asian crisis and escalating oil inventories. Prices dropped to $9.40 per barrel in December 1998, losing 60 percent from their December 1996 high.

FIGURE 2.14 The sharp tumble in Asian economic growth exacerbated the 1997–1998 decline in oil prices, but the recovery in subsequent years was swift in both growth and prices.

OIL THRIVES ON WORLD GROWTH, DOT-COM BOOM (1999–2000)

The U.S. economy remained largely insulated from the Asian crisis, and the dollar held firm all through 1997–1999. Beginning in 1996, U.S. inter-est rates were higher than those in Germany (and later the Eurozone after 1999) and Japan. Low interest rates and a shrinking budget deficit helped the economy grow by more than 4 percent in 1997, 1998, and 1999, the highest three-year growth period since the mid-1980s. The global tech rally powered by the Internet bubble was a boon for U.S equities as it was for the dollar. After averaging a monthly drop of 99 percent and 134 percent in 1996 and 1997 respectively, growth of net foreign purchases of U.S. equi-ties rose 1,448 percent, 59 percent, and 34 percent in 1998, 1999, and 2000 respectively. The dollar increased in value by 13 percent in 1997, fell 6 per-cent in 1998 due to three Fed rate cuts in the third and fourth quarters, and then rose 8 percent and 9 percent in 1999 and 2000.

PLEASE READ ALSO : IRAQ WAR FUELS OIL RALLY, DOLLAR FLOUNDERS, CHINA TAKES OVER (2002 TO PRESENT)

The period 1999–2000 proved a rare example of a broadening global expansion feeding into higher demand for the fuel. Even the Eurozone area, which averaged an annual growth of 2.2 percent between 1980 and 1998, broke the 3 percent growth mark in 1999 and 2000, registering the first 3 percent handle in nine years. Oil rallied from a low of $9.40 per barrel in December 1998 to a high of $30.50 per barrel in September 2000.

The burst of the technology bubble in 2000 culminated in a prolonged worldwide stock market decline, which was further exacerbated by the September 11 attacks the following year. The U.S. economy entered a re-cession in 2001, dragging world GDP growth down to 2.5 percent in 2001 from 4.8 percent in 2000. Growth in advanced economies cooled down to 1.2 percent in 2001 from 4 percent in 2000. U.S. oil demand slowed to 0.9 percent in 2000 before contracting 0.3 percent in 2001. Oil prices fell 50 per-cent from their September 2000 high to under $16 per barrel in December 2001.

OIL THRIVES ON WORLD GROWTH, DOT-COM BOOM (1999–2000)

The U.S. economy remained largely insulated from the Asian crisis, and the dollar held firm all through 1997–1999. Beginning in 1996, U.S. inter-est rates were higher than those in Germany (and later the Eurozone after 1999) and Japan. Low interest rates and a shrinking budget deficit helped the economy grow by more than 4 percent in 1997, 1998, and 1999, the highest three-year growth period since the mid-1980s. The global tech rally powered by the Internet bubble was a boon for U.S equities as it was for the dollar. After averaging a monthly drop of 99 percent and 134 percent in 1996 and 1997 respectively, growth of net foreign purchases of U.S. equi-ties rose 1,448 percent, 59 percent, and 34 percent in 1998, 1999, and 2000 respectively. The dollar increased in value by 13 percent in 1997, fell 6 per-cent in 1998 due to three Fed rate cuts in the third and fourth quarters, and then rose 8 percent and 9 percent in 1999 and 2000.

PLEASE READ ALSO : IRAQ WAR FUELS OIL RALLY, DOLLAR FLOUNDERS, CHINA TAKES OVER (2002 TO PRESENT)

The period 1999–2000 proved a rare example of a broadening global expansion feeding into higher demand for the fuel. Even the Eurozone area, which averaged an annual growth of 2.2 percent between 1980 and 1998, broke the 3 percent growth mark in 1999 and 2000, registering the first 3 percent handle in nine years. Oil rallied from a low of $9.40 per barrel in December 1998 to a high of $30.50 per barrel in September 2000.

The burst of the technology bubble in 2000 culminated in a prolonged worldwide stock market decline, which was further exacerbated by the September 11 attacks the following year. The U.S. economy entered a re-cession in 2001, dragging world GDP growth down to 2.5 percent in 2001 from 4.8 percent in 2000. Growth in advanced economies cooled down to 1.2 percent in 2001 from 4 percent in 2000. U.S. oil demand slowed to 0.9 percent in 2000 before contracting 0.3 percent in 2001. Oil prices fell 50 per-cent from their September 2000 high to under $16 per barrel in December 2001.

0 Response to "IRAQ’S INVASION OF KUWAIT AND THE GULF WAR (1990–1991) AND THE ASIAN CRISIS AND OPEC’s MISCALCULATION (1997–1998)"

Post a Comment