THE ROLE OF THE SPECULATORS AND GOLD IS PART OF A LARGER STORY

As the commodity boom got under way, much talk circulated regarding the role of speculators in accelerating the rally in commodities. Chapter 8 is devoted strictly to the fundamentals underpinning the rise in gold and metals as well as energy and agricultural commodities. But let us take a glance at the role of speculators in gold over the past 17 years.

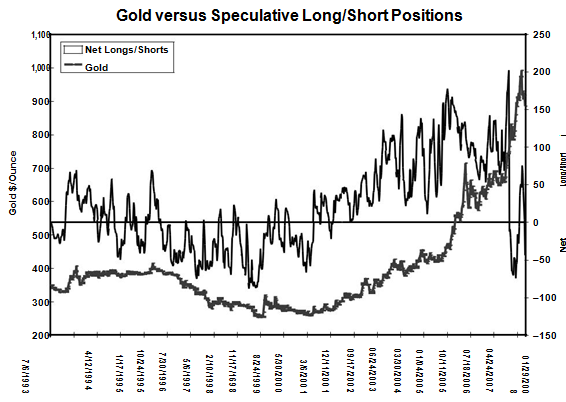

Figure 1.16 indicates a fairly positive correlation between the price of gold and the amount of net long/short positions accumulated in the metal

FIGURE 1.16 Speculators in gold futures contracts have helped boost gold prices but are not the main driver to the rally.

by futures speculators on the Chicago Mercantile Exchange in Chicago. Note, however, toward the end of the chart how the amount of interest plummeted from a record high of 201,859 net long contracts (more buy-ers than sellers) in October 2007 to an eight-year high of 74,343 net short contracts (more sellers than buyers) in January 2008. Despite the sharp re-versal in net longs to net shorts during the three-month period, the price of gold remained on the rise, soaring from $750 per ounce to $895 per ounce over the same period. Thus, although the speculators have signifi-cantly curtailed their long positions, they could not reverse the price ac-tion in the metal, which was boosted by such events as the assassination of former Pakistani Prime Minister Benazir Bhutto, renewed erosion in U.S. and global financial markets over subprime loans in the United States, and aggressive interest rate cuts by the Federal Reserve.

In further supporting the notion that speculators are not the principal drivers of gold’s run-up, the breadth of the commodities story acts as a firm testament to the realities favoring metals and the rest of commodi-ties. Figure 1.17 illustrates the evolution of the various commodity groups since January 2001. Note how the gold rally preceded all other commodi-ties, starting as early as the third quarter of 2001 before accelerating its advances in the first quarter of 2002 once the dollar had peaked. Gold ral-lied more than 35 percent between January 2001 and February 2003, until oil caught up with the metal later that month as oil traders bid up the fuel ahead of the 2003 Gulf War. The relationship between oil and the dollar is discussed in more detail in Chapter 2.

For currency investors, not only is it important to determine the trend in gold versus the dollar and other currencies, but it is also essential to as-sess its performance relative to other commodities. Thus, if a rally in gold is accompanied by other commodity groups, as was the case in 2003, 2004, and 2007, then the U.S. dollar is more likely to be subject to broader secu-lar pressure. If, however, a strengthening in gold occurs independently of the other commodity groups, then the dollar has more chances of holding its own.

The expansion of global foreign exchange markets, along with the emergence of a new array of several economies from the developed and de-veloping world, has given rise to a multitude of new currencies to be traded by institutional as well as individual players. Making decisions about which currencies offer the most profitable opportunities can be as challenging as it is costly. Using gold as a common denominator measure of a group of

FIGURE 1.17 Gold’s bull market preceded other commodities by nearly a year, before the dollar decline triggered a more universal rally in commodities.

please read also : OIL FUNDAMENTALS IN THE CURRENCY MARKET FROM A GOLD STANDARD TO AN OIL STANDARD (1970S–1980S) AND OIL PRICE SHOCKS FUELED BY MOUNTING INFLATION, FALLING DOLLAR

currencies enables one to rank these different currencies by order of per-formance, thereby facilitating the decision to buy the stronger currencies versus their weakest counterparts. For contrarian investors preferring to pick up trends before they occur, a similar exercise may be used to buy and sell currencies near the top and bottom of the ranking of returns. Besides currency valuation and ranking, traders may also compare gold’s perfor-mance with that of other commodities to gauge whether the metal’s behav-ior is part of an overall commodity trend or an exceptional phase pertaining to it exclusively.

Global financial markets have become more interconnected than they ever were in the past. Identifying the evolving forces shaping broader cur-rency flows via gold is a prerequisite in grasping the currency-commodity relationship, which is explored in more detail in Chapter 8.

0 Response to "THE ROLE OF THE SPECULATORS AND GOLD IS PART OF A LARGER STORY"

Post a Comment