RECENT EXCEPTIONS TO THE INVERSE RULE AND USING GOLD TO IDENTIFY CURRENCY LEADERS AND LAGGARDS

RECENT EXCEPTIONS TO THE INVERSE RULE

As with all close relationships between two assets, the USD-gold relation-ship has not been without its temporary periods of decoupling. The most Gold and the Dollar.

FIGURE 1.3 Monthly correlation between gold and U.S. dollar index from January 1999 to May 2008 ran as high as −0.84, with a slight break in the relationship in 2005.

striking break in the relation occurred between April and December 2005 when both gold and the dollar appreciated. Figure 1.4 shows that the cor-relation had run as high as 0.66, showing a remarkably strong positive re-lationship. The explanation for this unusual correlation relates to develop-ments pertaining to gold, the dollar, and the euro.

Gold was in the midst of a secular bull market that had started in 2001 and gathered strength in 2002 with the peak and the subsequent decline in the dollar. The rally was further intensified by the 2005 revaluation of China’s currency, which enabled it to step up appetite for gold and other commodities.

The dollar’s role in the temporary break in the USD-gold inverse relationship owed to the two-year campaign of U.S. interest rate increases (from June 2004 to June 2006), which lifted U.S. short-term interest rates above their Eurozone counterpart in the fourth quarter of 2004 for the first time in three years. As the U.S. interest rate advantage over the Eurozone was further widened by the Fed’s 2005 rate hikes, the U.S. dollar strength-ened against the euro, especially as the European Central Bank maintained rates at a historic low of 2.0 percent.

Also contributing to the dollar’s 2005 recovery was a temporary tax break granted by the Bush administration to U.S. multinationals, allow-ing them to repatriate their profits from their overseas subsidiaries. The

As with all close relationships between two assets, the USD-gold relation-ship has not been without its temporary periods of decoupling. The most Gold and the Dollar.

FIGURE 1.3 Monthly correlation between gold and U.S. dollar index from January 1999 to May 2008 ran as high as −0.84, with a slight break in the relationship in 2005.

striking break in the relation occurred between April and December 2005 when both gold and the dollar appreciated. Figure 1.4 shows that the cor-relation had run as high as 0.66, showing a remarkably strong positive re-lationship. The explanation for this unusual correlation relates to develop-ments pertaining to gold, the dollar, and the euro.

Gold was in the midst of a secular bull market that had started in 2001 and gathered strength in 2002 with the peak and the subsequent decline in the dollar. The rally was further intensified by the 2005 revaluation of China’s currency, which enabled it to step up appetite for gold and other commodities.

The dollar’s role in the temporary break in the USD-gold inverse relationship owed to the two-year campaign of U.S. interest rate increases (from June 2004 to June 2006), which lifted U.S. short-term interest rates above their Eurozone counterpart in the fourth quarter of 2004 for the first time in three years. As the U.S. interest rate advantage over the Eurozone was further widened by the Fed’s 2005 rate hikes, the U.S. dollar strength-ened against the euro, especially as the European Central Bank maintained rates at a historic low of 2.0 percent.

Also contributing to the dollar’s 2005 recovery was a temporary tax break granted by the Bush administration to U.S. multinationals, allow-ing them to repatriate their profits from their overseas subsidiaries. The

FIGURE 1.4 The gold-U.S. dollar relationship became positive in 2005 due to higher U.S. interest rates, temporary U.S. tax incentives, and political Eurozone un-certainty, while gold rallied on strong Chinese demand.

Homeland Investment Act, designed to improve job creation, slashed the tax on multinationals’ overseas profits from 35 percent to 5.25 percent. U.S. multinationals rushed to take advantage of the substantial tax break and repatriated an estimated $600 billion, prompting a surge of inflows into U.S. dollars from euros, especially in the second half of the year. Unsurprisingly, the temporary inflows of 2005 gave the dollar its best annual performance against the euro since 1999.

Since the euro makes up 58 percent of the dollar index, it is worth mentioning one factor specific to the Eurozone behind the euro’s 2005 de-cline against the dollar and other major currencies. France’s rejection of a proposed European Union Constitution dealt a blow to confidence in the European Union and the future of its currency, particularly because France is the second-largest economy of the Eurozone.

USING GOLD TO IDENTIFY CURRENCY LEADERS AND LAGGARDS

Assessing the performance of currencies against the value of gold enables a transparent examination of the strength of a nation’s currency, without

the influence of dynamics in other currencies and their economies. A rising euro against the U.S. dollar, for instance, may not necessarily be a reflec-tion of improved fundamentals in the Eurozone but of deteriorating fun-damentals, technicals, and/or sentiment in the U.S. dollar. Meanwhile, the euro could be selling off against the Japanese yen and be little changed against the British pound—a different performance from that against the dollar. Charting the euro against gold would allow for a secular view of the euro, which is not influenced by factors specific to individual currencies. Unlike currencies, which are largely influenced by interest rate movements resulting from economic policies and capital flows, gold is mainly a reflec-tion of supply and demand, and not a direct result of any particular central bank actions.

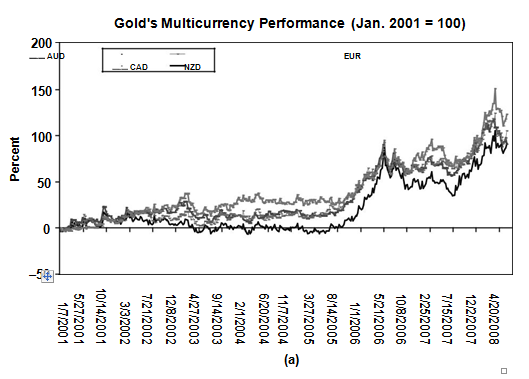

Charting several currencies against the price of gold presents a broader view of currencies against a neutral asset such as gold, enabling a less bi-ased look at the currency in question. Figure 1.5a shows the percentage increase in the value of gold against the aussie (Australian dollar, AUD), loonie (Canadian dollar, CAD), euro (EUR), and kiwi (New Zealand dollar, NZD) from January 2001 to May 2008. All charts show an uptrend, reflect-ing gold’s appreciation against all currencies since 2001. The graph with the least appreciation throughout most of the eight-year period is against the loonie, showing that gold grew the least against the Canadian currency. Nonetheless, at the end of the period, gold ended up 90.5 percent against the aussie versus 123 percent against the loonie, meaning gold’s appreci-ation was the least against the Australian dollar. This suggests that the Aussie was the best-performing currency in the group. The weaker increase in gold against the AUD, CAD, and NZD reflected the broad rally in those currencies due to their dependence on rising commodities as well as high interest rates prevailing throughout the period.

Similarly, Figure 1.5b measures gold against the U.S. dollar, Swiss franc (CHF), Japanese yen (JPY), and British pound (GBP) over the same period. Note how gold’s performance against these currencies was mostly higher than its performance in Figure 1.5a, suggesting these currencies have un-derperformed the AUD, CAD, EUR, and NZD. Thus, with gold showing the highest percentage increase against the USD and the lowest percentage increase against the AUD, we can conclude that playing the AUD/USD cur-rency pair (buying AUD and selling USD) would have produced the highest rate of return if held between January 2001 and May 2008. Indeed, opportu-nities in foreign exchange markets are not limited solely to trading curren-cies against the USD, but also in those pairs involving non-USD currencies. Charting gold against different currencies over a three- or six-month pe-riod enables a truer assessment of individual currencies than comparing them against the dollar or the euro. This way, traders can not only de-termine the secular performance of currencies but may also rank them

FIGURE 1.5 Measuring gold in various currencies enables more secular assess-ment of those currencies and better determination of strongest and weakest players.

in order of strength and be better able to buy the strongest against the weakest.

Figure 1.6 shows a more recent performance of gold against AUD, GBP, JPY, and USD, measuring currencies between January 2007 and May 2008. The aussie was the strongest performer against gold, followed by

FIGURE 1.6 Gold’s performance was weakest against AUD and JPY between Jan-uary 2007 and May 2008, illustrating the strength in both of these currencies relative to GBP and USD.

yen, which fared significantly better than in Figure 1.5a. The yen’s improve-ment owed primarily to the unwinding of carry trades as traders exited po-sitions in high-yielding currencies and shifted their proceeds back to the lower-yielding yen for safety. Carry trades are discussed in more detail in Chapter 5.

Homeland Investment Act, designed to improve job creation, slashed the tax on multinationals’ overseas profits from 35 percent to 5.25 percent. U.S. multinationals rushed to take advantage of the substantial tax break and repatriated an estimated $600 billion, prompting a surge of inflows into U.S. dollars from euros, especially in the second half of the year. Unsurprisingly, the temporary inflows of 2005 gave the dollar its best annual performance against the euro since 1999.

Since the euro makes up 58 percent of the dollar index, it is worth mentioning one factor specific to the Eurozone behind the euro’s 2005 de-cline against the dollar and other major currencies. France’s rejection of a proposed European Union Constitution dealt a blow to confidence in the European Union and the future of its currency, particularly because France is the second-largest economy of the Eurozone.

USING GOLD TO IDENTIFY CURRENCY LEADERS AND LAGGARDS

Assessing the performance of currencies against the value of gold enables a transparent examination of the strength of a nation’s currency, without

the influence of dynamics in other currencies and their economies. A rising euro against the U.S. dollar, for instance, may not necessarily be a reflec-tion of improved fundamentals in the Eurozone but of deteriorating fun-damentals, technicals, and/or sentiment in the U.S. dollar. Meanwhile, the euro could be selling off against the Japanese yen and be little changed against the British pound—a different performance from that against the dollar. Charting the euro against gold would allow for a secular view of the euro, which is not influenced by factors specific to individual currencies. Unlike currencies, which are largely influenced by interest rate movements resulting from economic policies and capital flows, gold is mainly a reflec-tion of supply and demand, and not a direct result of any particular central bank actions.

Charting several currencies against the price of gold presents a broader view of currencies against a neutral asset such as gold, enabling a less bi-ased look at the currency in question. Figure 1.5a shows the percentage increase in the value of gold against the aussie (Australian dollar, AUD), loonie (Canadian dollar, CAD), euro (EUR), and kiwi (New Zealand dollar, NZD) from January 2001 to May 2008. All charts show an uptrend, reflect-ing gold’s appreciation against all currencies since 2001. The graph with the least appreciation throughout most of the eight-year period is against the loonie, showing that gold grew the least against the Canadian currency. Nonetheless, at the end of the period, gold ended up 90.5 percent against the aussie versus 123 percent against the loonie, meaning gold’s appreci-ation was the least against the Australian dollar. This suggests that the Aussie was the best-performing currency in the group. The weaker increase in gold against the AUD, CAD, and NZD reflected the broad rally in those currencies due to their dependence on rising commodities as well as high interest rates prevailing throughout the period.

please read also : GOLD’S SECULAR PERFORMANCE AND VALUING CURRENCIES VIA GOLD

FIGURE 1.5 Measuring gold in various currencies enables more secular assess-ment of those currencies and better determination of strongest and weakest players.

in order of strength and be better able to buy the strongest against the weakest.

Figure 1.6 shows a more recent performance of gold against AUD, GBP, JPY, and USD, measuring currencies between January 2007 and May 2008. The aussie was the strongest performer against gold, followed by

FIGURE 1.6 Gold’s performance was weakest against AUD and JPY between Jan-uary 2007 and May 2008, illustrating the strength in both of these currencies relative to GBP and USD.

yen, which fared significantly better than in Figure 1.5a. The yen’s improve-ment owed primarily to the unwinding of carry trades as traders exited po-sitions in high-yielding currencies and shifted their proceeds back to the lower-yielding yen for safety. Carry trades are discussed in more detail in Chapter 5.

0 Response to "RECENT EXCEPTIONS TO THE INVERSE RULE AND USING GOLD TO IDENTIFY CURRENCY LEADERS AND LAGGARDS"

Post a Comment